- In the most recent round of regulatory tightening, the US Commerce department announced that Nvidia’s existing lineup of China-compliant chips are subject to licensing

- While the USD5.5bn financial charge is far from trivial, its long-term impact on Nvidia and peers is expected to be minimal

- Significant capital outlays by cloud hyperscalers reflect a long-term commitment to scaling AI capabilities, creating compelling business opportunities for industry leaders

- This development remains a multi-year trend with significant runway ahead, and we continue to advocate for exposure by adopting the CIO I.D.E.A. framework

Related insights

- Digital Realty Trust Inc13 Jun 2025

- Research Library13 Jun 2025

- FX Tactical Ideas: Tariffs and Geopolitical Tensions Boost Haven Demand13 Jun 2025

New export restrictions on semiconductor chips. The US is tightening restrictions on advanced chip exports to China, most recently blocking Nvidia’s H20 AI chips—underscoring rising geopolitical tensions. Aimed at curbing China’s AI and military advancements, the move signals both short-term risks and long-term strategic adjustment across the global semiconductor landscape. Despite near-term volatility, we maintain our high conviction on the sector under our CIO I.D.E.A. strategy, powered by structural tailwinds like AI, edge computing, cloud platform proliferation, and global supply chain rebalancing.

Background information. The US Commerce department implemented export controls in October 2023, requiring licenses for the export of advanced chips to China. In the most recent round of regulatory tightening, even Nvidia’s existing lineup of China-compliant chips (H20, L20, L2) are now subject to licensing. The H20 chip is already a downward modified version of Nvidia’s powerful flagship H100 GPU, in compliance with US export controls.

In response, Nvidia has flagged a possible USD5.5bn financial charge. While the figure is far from trivial, its long-term impact on the GPU giant is expected to be minimal (Figure 1), given Nvidia’s dominant position and structural growth trajectory.

The timing could not have been worse, triggering short-term market jitters over revenue headwinds across IC design firms. However, this disruption will likely be offset by accelerating demand from hyperscalers in the US, Europe, Asia, and the Middle East.

Nvidia CEO’s recent visit to China underscores the country's continued importance as a key market, suggesting that new policy developments would not sever business ties—likely also reflecting similar sentiment across the global tech industry.

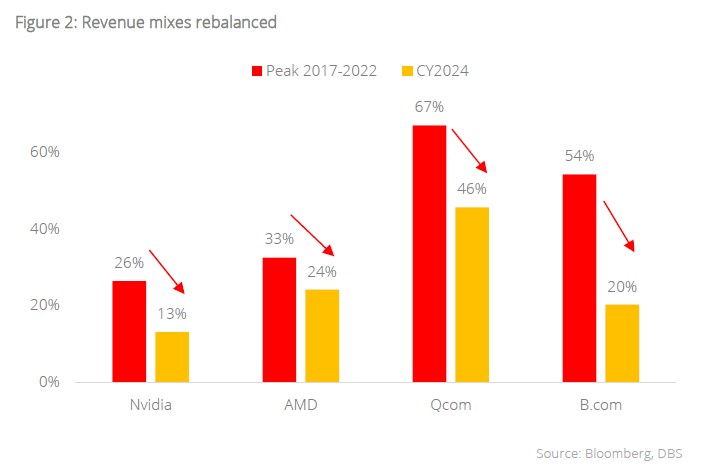

Rebalancing of revenue mix. Notably, leading IC design firms are undergoing a significant rebalancing in their revenue mix, with China’s contribution steadily declining. Nvidia’s China-derived revenue has dropped by half—from a peak of 26% to just 13%. Broadcom shows a similar trend, with China now contributing only 20%, down sharply from 54% at its peak (Figure 2).

This shift signals a reduced dependency on a single market without compromising the growth trajectory, with geographic diversification and strong global demand particularly from the US, Europe, and the Middle East, to cushion potential revenue shocks.

All is not lost.Hope is far from lost for the semiconductor industry as AI is igniting a powerful new wave of investment. Nvidia alone is committing USD500bn to build out onshore AI infrastructure, while the top three hyperscalers—Microsoft, Amazon, and Google—plan to invest a combined USD250bn in 2025 on AI infrastructure, data centres, chip procurement, and next-gen algorithms to drive ecosystem growth (Figure 3).

These massive capital outlays reflect a long-term commitment to scaling AI capabilities, creating compelling opportunities for technology innovators and enablers. This reinforces our high-conviction investment thesis for this powerful secular trend.

Similarly, the Middle East is stepping up its efforts to ensure it is not left behind in the AI revolution, with an estimated USD100bn committed to investments in AI-driven technology over the remainder of the decade. The commitment of capital worldwide, from the West to the East, accentuates the strategic importance of AI infrastructure buildout. It enhances competitiveness and extends the already-long runway of opportunity for the global semiconductor and technology supply chain.

Capital spending to stay resilient. This dynamic wave of capital spending highlights the rising demand for next-gen AI capabilities, driving a surge in the need for high-performance logic, passive, and memory chipsets. This creates a lucrative opportunity for upstream semiconductor players to capitalise on the commercial benefits of advanced innovation.

Innovations lead the way. The technology sector, known for its relentless innovation, has precipitated several standout opportunities that could drive companies to emerge stronger and more resilient in the future.

- Geographic diversification: Tap into booming demand from non-China markets, such as the UAE's G42 project, Saudi Arabia's USD100bn AI plan, India’s USD 1.2bn Digital India AI initiative, and AI investments by Southeast Asia’s platform firms.

- Strategic partnerships: Strengthen the dependence on US based capacity (TSMC Arizona + Oregon, Global Foundry, Samsung Texas), while utilising fabrication capacity in other locations for overseas orders.

- Product diversification: The diversity of AI chip architectures and capabilities allows companies to navigate export restrictions to various markets.

- Software and applications: Increase the mix of software and application solutions to reduce direct reliance on hard microprocessors. Nvidia’s CUDA, cuDNN, and AI software stack are examples of how software can strengthen the competitive moat.

While the US-China chip tensions present regulatory uncertainty, the secular transformation of AI globally offers growth opportunities for leading IC design firms, software application developers, platform firms, and the broader semiconductor sector.

Robust total addressable market points to a bright future. The global semiconductor market is projected to hit USD1tn by the end of the decade, growing at an annual rate of 29% (Figure 4). On a larger scale, global tech spending is set to exceed USD5tn this year, surpassing the entire economy of Germany (Figure 5).

In conclusion, we are confident that this development remains a multi-year trend with significant runway despite the fact that sentiment around AI and related supply chains may have hit a temporary hurdle. As such, we continue to advocate for exposure to Big Tech companies and global industry leaders that are poised for long-term secular growth. In the broader technology universe, we recommend maintaining diversification across key verticals and regions, anchored by the robust CIO I.D.E.A. framework, while staying focused on trendsetters and price makers with proven profit resilience.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Digital Realty Trust Inc13 Jun 2025

- Research Library13 Jun 2025

- FX Tactical Ideas: Tariffs and Geopolitical Tensions Boost Haven Demand13 Jun 2025

Related insights

- Digital Realty Trust Inc13 Jun 2025

- Research Library13 Jun 2025

- FX Tactical Ideas: Tariffs and Geopolitical Tensions Boost Haven Demand13 Jun 2025